|

|

|

|

|

|

|

|

|  |

Photo taken at a panel discussion of the tourism industry in China |

|

Connect StoryJenking ShaoExecutive Director at Legend Capital

(Full-time, Class of 2008)

After graduation, I started my career as an IT guy. I was an IBM Certified Specialist and Instructor in iSeries servers for three years, then I went into international trading and engineering for another three and a half years.

The most special experience in the second part of my career was working as a project manager and becoming the company’s chief representative in Nigeria, where we sold turnkey infrastructure projects in the telecom and electricity sectors.

With my engineering background from college, I felt more and more that my management knowledge was deficient as I had to handle an increasing number of management issues, such as financing, marketing and operations. Although I learnt a lot on the job, I got to the conclusion that a systematic study of management would greatly help me to dynamically face future challenges.

CUHK was the best choice for me, because it was international and diversified with several decades of history, I could get good exposure to a large MBA alumni network and, most importantly, the MBA program combined Asian and Western traditions.

| |

| What was your most remarkable achievement at CUHK MBA?

My MBA life was very intensive and productive. Apart from getting a competitive GPA score and receiving the Sino Land Excellent Student Prize, I also spent a lot of time in business practicum. As the team leader, I led my team to win twice at the L’Oréal Strategy Challenge Episode 7 and 8 as HK champions, and enter the YEDC Entrepreneurs’ Challenge as finalists. I worked closely with HP’s country manager and marketing manager to conduct a strategic marketing research on the target markets of IT outsourcing, including macro-environment analysis, trend forecast and competitive analysis. These experiences in real business gave me a preliminary practice for my future career and helped me establish a framework of management.

| |

|  |

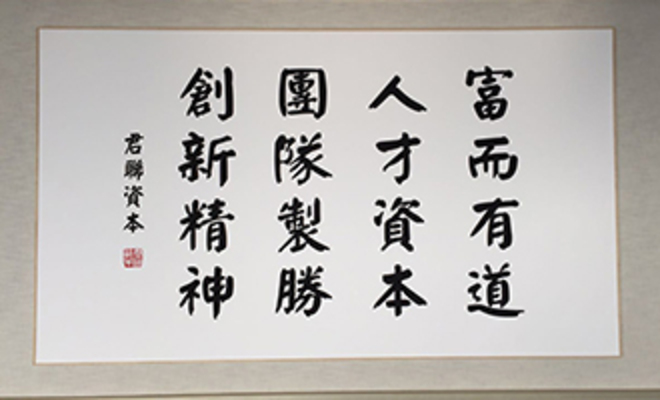

One of the Investment Philisophy of Legend Capital: Pursue Fortune with Principles |

| How did you start your present job and how did you make the transition from engineering to fund management?

I began to plan my post-MBA career development during my MBA studies. Finance, consulting and IT are the top three industries in terms of post MBA employment. However, at the time I didn’t know what kind of positions and functions there were within those industries and what the job requirements were. Fortunately, CUHK MBA provided many skill training programs and opportunities for us to get in touch with employers in those industries. We had several ways to meet them, such as CEO talks, company visits and recruitment talks. I gradually focused my career target at finance and within that VC/PE, as this matched my background, interest and skill set pretty well. Therefore, I chose to intern with a VC during the summer and took several related courses during my exchange program at the University of Chicago. I joined a China VC/PE trek after the exchange program and visited around 20 top VC/PE firms in Beijing and Shanghai. As a result, I got several job interviews and finally chose Legend Capital, where I began my VC/PE career.

| |

| What are the most exciting and challenging elements of your role in the VC/PE industry?

As one of the partners of the fund, the challenge for me is to manage my time, energy and resources, and allocate them to fund management, deal investment, post-investment management and team management, as well as fundraising and investment strategy.

Finding the right company and helping them grow into a large company, which can influence or even change the industry, is the most exciting part of the VC/PE industry, but it always takes a long time to make it happen.

| |

| What kind of return on investment are you targeting with these businesses?

For early-stage investment, we normally target a return of more than 10 times and for late-stage investment 3 to 5 times the investment during our holding period, due to the different risk exposure.

| |

|  | Investment Philosophy of Legend Capital

(reading from the top to bottom, right to left):

Pursue Fortune with Principles

Talent is Capital

Team Wins

Innovative Spirit

|

| What aspects do you look at when choosing the right investment target? Does the “gut feeling” have any role in making an investment decision?

Before we look at any investment opportunities, we need to study the target industries with a systematic top-down method and figure out the industries’ future trends and internal rules. Then we look at the major players and normally select the top ones for further work. We are guided by “Business First” and “People Are Crucial” as the two basic strategies to keep in mind when choosing the right investment targets. We also care about the core team’s background, vision, learning capacity, and complementarity. Finally, we look at whether the people match our business. Gut feeling only comes into play under some special circumstances, for example when the investor understands the industry very well and also has extensive investment experience.

| |

| How do you do fundraising and how did your MBA prepare you for that?

Startups seek finance from venture capital, while VC/PEs seek finance from their limited partners (LPs). The major LPs are from pension funds, endowment funds, family offices, financial institutions, and listed companies. We kick off any new fund raising by preparing the Private Placement Memorandum (PPM) and do a lot of roadshows to potential LPs. In turn, they will carry out due diligence on the fund’s key individuals before making a final decision. The MBA’s alumni network is helpful in connecting me to some of the potential LPs.

| |

|

| Could you please detail what “post-investment management” covers and how you add value to the start-ups apart from straightforward investment into their business?

As a board director, first we get involved in the corporate governance of the portfolio. We help the board to plan the company’s strategy for the next three to five years and help the management establish basic management tools, such as a KPI system, incentive management and operation management, including marketing, public relations and government relations. We have invested in close to 300 companies in last 15 years and, most importantly, many of them have good synergies on a business level.

| |

|  | Jenking was the moderator on 15th CEO Club of Legend Capital |

| How large is your team and what kind of challenges do you have to face in team management?

We have more than 50 professionals in Legend Capital and out of that, about 10 people are in my team. At entry level, junior professionals are required to have at least three to five years’ management experience in a related industry. That means most junior professionals were probably already senior staff in their past career. Besides, people always describe VC/PE investment as sort of an art, rather than a routine job. Managing people in the VC/PE industry is an absolute challenge. We don’t have KPI, what we have is 360 degree evaluation, because our investments are always long term. We have investment procedures, but we don’t have any guidance for our daily job, therefore the best way to lead the team is to make them self-driven. Communication and sharing are very important for team work. Here I apply almost all the soft skills I learnt during my MBA program and in my past career.

| |

| Do you have any management or time management tips to share with our readers?

The methodology of “7 habits” is very useful for time management. This workshop provided us with a lot of fun and inspiration during our MBA program. Always do the important and urgent tasks first, and relegate those which are not important or urgent. Update your to-do list every day and try to make a plan on a monthly rather than weekly basis. Change any inefficient habits you might have and try to use tools to help your time management.

| |

|

Lastly, what advice would you give to those who are considering an MBA?

An MBA can be key to one’s future in the world of business, helping both in terms of theoretical knowledge and hands-on experience. The MBA also helps develop important soft skills, such as teamwork, interpersonal and leadership skills, among others. To understand oneself and figure out one’s future path can be the biggest gain for an MBA candidate.

| |

|

|

|

|

|

|

|